A comprehensive analysis of the U.S. dollar's recent gains, driven by inflation data and expectations of a modest Federal Reserve rate cut. Insights into currency movements and market trends.

The U.S. dollar strengthened on Friday following the release of key inflation data that met expectations, alongside increases in both personal spending and income. This data reinforced the view that the Federal Reserve is likely to implement a more modest 25 basis point interest rate cut next month.

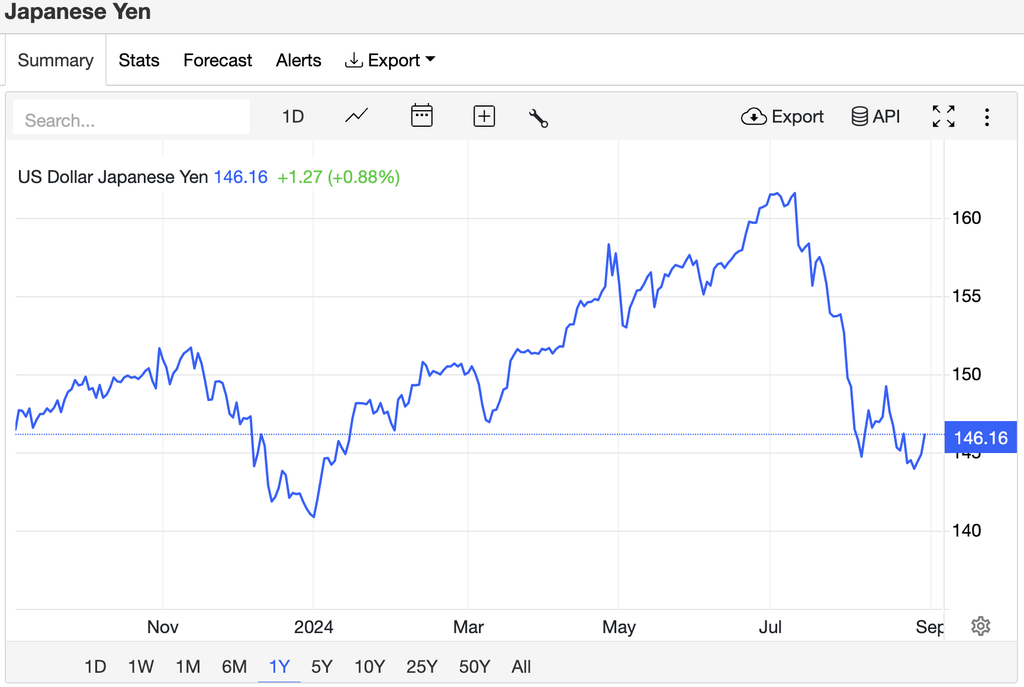

The dollar appreciated by 0.8% against the yen, reaching 146.12, and posted a 1.2% gain for the week, positioning it for its largest weekly advance since mid-June. Despite these gains, the dollar remains down by 2.9% for August, marking its second consecutive monthly decline against the Japanese currency.

The data released on Friday showed that the personal consumption expenditures (PCE) price index rose by 0.2% in July, in line with forecasts, following an unchanged 0.1% increase in June. On an annual basis, the PCE price index increased by 2.5%, consistent with the previous month’s figures. Additionally, consumer spending increased by 0.5% in July, building on a 0.3% rise in June.

Recent inflation trends have been relatively stable, with consumer spending continuing to exceed expectations. As a result, a 25 basis point interest rate cut in September is widely anticipated, although the upcoming jobs report will be closely monitored for any factors that could influence the decision.

On Friday, U.S. rate futures reflected a 31% probability of a 50 basis point rate cut next month, down from 35% on Thursday. The market has fully priced in a 25 basis point cut, which would be the Federal Reserve's first rate reduction in over four years. Additionally, market projections suggest approximately 100 basis points of rate cuts by the end of 2024.

The dollar index, which measures the currency against a basket of six major peers, rose to a 10-day high after the inflation data, gaining 0.3% to reach 101.69. For the week, the index increased by 0.8%, marking its strongest weekly performance since early April. However, the index posted a 2.4% decline for the month, its weakest performance since November of the previous year.

The dollar's recent gains were supported by month-end flows, following earlier sell-offs after signals emerged that the U.S. central bank would cut interest rates at its September meeting.

In other currency movements, the euro depreciated against the dollar to $1.1074, recording a 1% decline for the week, its largest weekly loss since April. Despite this, the euro gained 2.3% in August, its strongest monthly performance since November 2023, driven by expectations that the European Central Bank will lower interest rates again next month. The euro fell to a more than one-week low on Thursday and ended the day down 0.4% after German inflation cooled more than anticipated, reinforcing expectations of further ECB rate cuts.

Disclaimer:

The information provided in this article is for educational purposes only and should not be construed as investment advice. estima...

Author

Shaik K is an expert in financial markets, a seasoned trader, and investor with over two decades of experience. As the CEO of a leading fintech company, he has a proven track record in financial products research and developing technology-driven solutions. His extensive knowledge of market dynamics and innovative strategies positions him at the forefront of the fintech industry, driving growth and innovation in financial services.